We direct intellectual and financial capital towards problems worth solving

Our Story

Aavishkaar Capital pioneered the venture capital approach of investing in early-growth stage enterprises in India in 2001, with a focus on geographies and sectors that were often overlooked and challenging. Aavishkaar Capital has gone on to close 8 funds since then, with close to half a billion dollars in AUM today.

Entrepreneurship based

approach to development

Along with its core objective of delivering commercial returns to its investors, Aavishkaar Capital creates livelihoods, reduces vulnerabilities, and provides access to essential products and services to the target population through its investments in ambitious and innovative entrepreneurs.

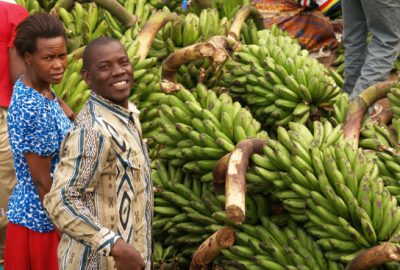

Over the years, Aavishkaar Capital‘s investment strategy has evolved to include other emergent geographies, in addition to India – Emerging Asia and Sub-Saharan Africa and has scaled – larger investment tickets, while maintaining a focus on investing in businesses across our 3 core sectors – Financial Inclusion, Food & Agriculture, and Essential Services.

The entrepreneurs backed by Aavishkaar Capital will continue to leverage opportunities in ways that help scale up their businesses while continue catering to include expectations of the emerging class, engaging them as consumers and/or as providers.

Our Investment Approach

Aavishkaar Capital’s investment thesis is to leverage the confluence of consumption, financial inclusion and technology across emerging low and middle income populations to build sustainable, impactful and highly scalable businesses, which can create significant value for both the investors and the society. We invest $5Mn – $25 Mn in ticket size in early growth companies.

The Firm seeks to invest in businesses which meet the following criteria:

- Operations focused on the targeted demographics of the emerging 3 billion population.

- Business model with the potential to scale significantly within 4 to 5 years.

- Strong management team with the ability to capitalise on the market potential.

To achieve its goals, Aavishkaar Capital follows a multi-stage ‘sow-tend-reap’ investment strategy which supports businesses across the growth spectrum, from seed to growth stages, while building a portfolio with a balanced risk return profile. With an active investment style, the Firm supports the investee companies in building their capacity for growth by advising on strategy, governance, operational processes, human resources, and fundraising.

Our Culture

We are entrepreneurs behind entrepreneurs driven to create opportunity for the emerging 3 billion

Unconventional and Proud

Focus on deep-rooted and ignored problems

Balance of risk and action